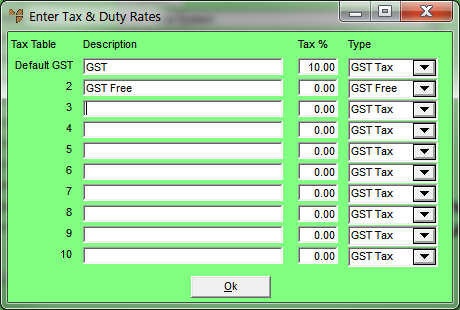

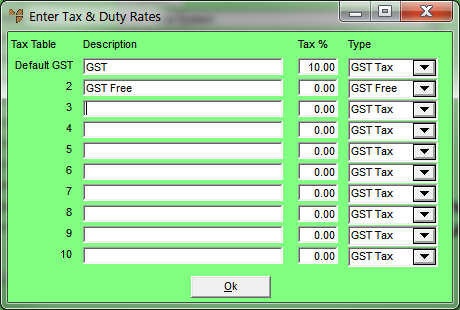

You use this option to setup the different tax rates that you want throughout Micronet, such as GST, WET (Wine Equalisation Tax) tax, GST free and gift vouchers (GST free). You can then enter the table numbers for these tax types in Sales Tax/GST fields throughout Micronet, rather than entering the applicable percentage each time.

There are 10 tax table fields available in Micronet, each with its own percentage rate. Inventory items in Micronet are each assigned a tax table setting that determines whether GST should be charged during sales invoicing.

Refer to "Selecting a Company to Edit"

Micronet displays the Enter Tax & Duty Rates screen.

|

|

Field |

Value |

|---|---|---|

|

|

Description | Enter a description of the tax type. |

|

|

Tax % | If tax applies to the tax type, enter the percentage. |

|

|

Type |

Select the type of tax rate you are creating:

|

|

|

|

Technical Tip The rate set at Tax Table 1 determines the tax percentage used to calculate GST or VAT or Tax system-wide. |

Micronet redisplays the Change Existing Company screen.

Refer to "Logging in With Updated Configuration (Method 1)" or "Logging In With Updated Configuration (Method 2)".